Why focusing on creative and investing in staff can help marketers in an increasingly regulated finance sector

Investment firm Hargreaves Lansdown has a healthy digital outlook in terms of marketing, but sector-specific regulation can hamstring efforts to improve the customer journey says Chris Worle.

Digital marketing has its quirks across different sectors, but in financial services, marketers have to work with one arm tied behind their back in terms of personalisation and simplifying the customer journey.

TFM spoke to Chris Worle, Digital Strategy Director, Hargreaves Lansdown, at the recent Adobe Customer Experience Forum to find out his thoughts on digital marketing in a heavily-regulated sector with such a long customer life cycle.

Founded in a spare bedroom in 1981, the FTSE100 provider of ISAs, pensions, funds and shares, Hargreaves Lansdown, is now the leading UK platform for private investors, enjoying over 90 million web visits per year.

A Simpler Time

Worle has been with Hargreaves Lansdown for nearly 15 years, but even as recently as 2008, he says that things used to be a lot simpler regarding digital marketing: “Back then we were still doing a lot of offline marketing such as adverts in a weekend newspaper where people would fill in the coupons and send them back. That used to be relatively simple to track and measure.”

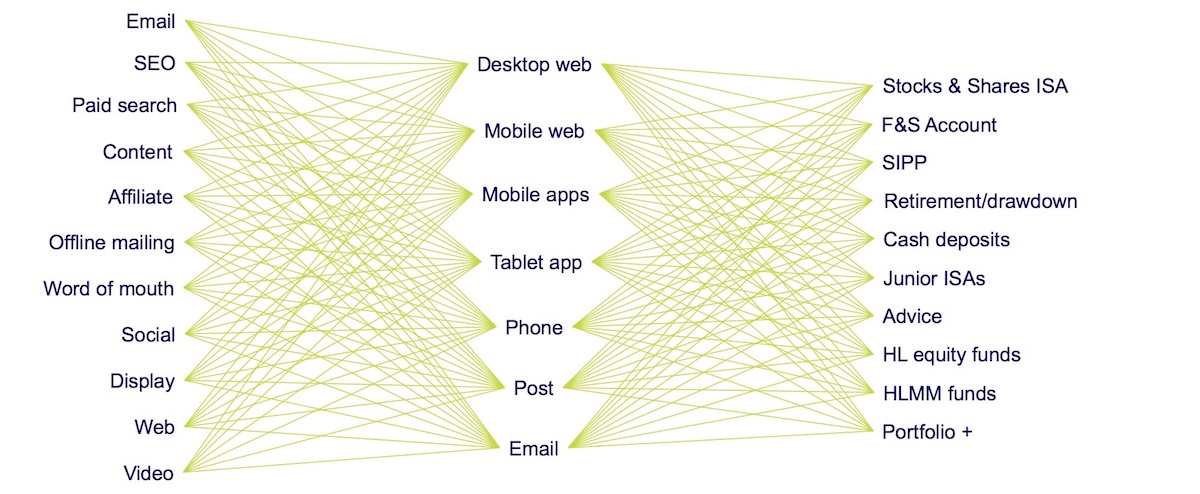

“What we’ve seen over the last five to ten years is an explosion of marketing channels from the early days of paid search through, to social media, to content marketing channels which are now a big part of what we do. Added to that, the different devices which people use to access us - the complexity of what we do has increased massively.”

In his presentation at the Adobe Customer Experience Forum, Worle talked of an explosion of channels, mediums and products:

This isn’t necessarily a bad thing for Worle himself, a “self-confessed data nerd” who “loves delving into the ins and outs of a good client journey. But it’s presented a huge technology challenge to make sure all that is visible and that you’re measuring it. You’ve also got to have the people in place to translate it all and understand what it means to the actual customer experience on the front end.”

Is established marketing wisdom being lost in the drive to digital?

Worle sees that there might be some old marketing wisdom being lost in the move to digital. “Part of what we’re hoping to do as a business is to use technology and data to inform [our channel strategies] in order to free up marketers to focus on creating great copy, great content and great experiences on the front end.

“The danger is that if you’re not matching that creative side, you miss out - particularly in our area of financial services because people do still ‘buy a story’. People will read an article about something and they’ll think it’s a good idea and buy into it. Ensuring that you’ve got that creativity available is really important, that’s what we need to hang on to. We’re looking at that structure at the moment in terms of how we organise marketing teams, ensuring that there are people focused on content that people want to engage with.”

Regulation: The customer journey optimisation straitjacket

One of the biggest challenges facing digital marketers working in financial services is regulation. Says Worle: “Without a doubt it holds us back in terms of what you can do with personalisation and targeting.” The world of Amazon’s "customers who bought this item also bought X,Y or Z" is simply not compatible with [financial services] regulations.

“It’s an increasing challenge. Understanding the customer journey and the work that we put into optimising it is often undone by regulation—there’s [always] more information that we need to put in the way of clients before they do stuff. It’s frustrating that it’s easier for people to open a gambling account in the UK today than it is for someone to do the right thing and start saving and investing for their future with an ISA or pension.”

Indeed, one can easily understand the frustration of having to add more information, clicks and forms into customer journeys for someone who’s job it is to reduce roadblocks and provide a better experience overall.

The epic customer journey to opening an investment account

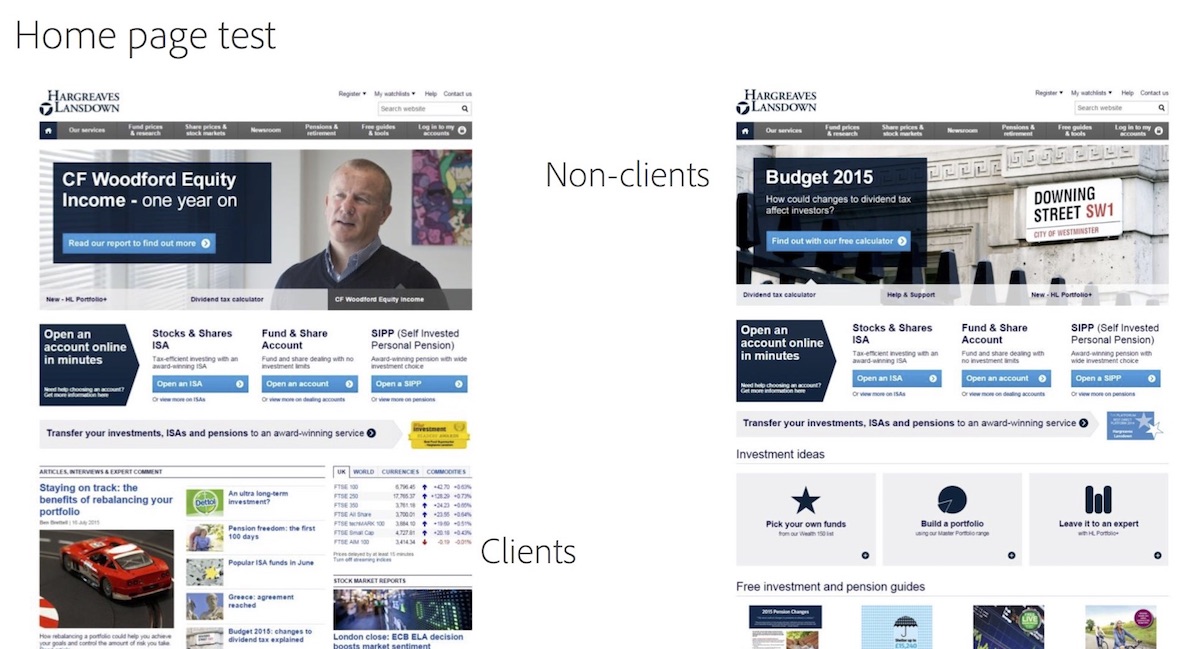

“On average it takes about 11 months from when someone makes their first enquiry to opening an account. That relationship that we build in the meantime is incredibly important - ensuring that we provide the right information and answers to questions through that journey.” Worle and team tested their home page content, serving different content to clients and non-clients. “We were simplifying that experience, surfacing more helpful, how-to information to those people who weren’t yet dealing with us.”

“It was incredibly successful and really effective.”

The team tested 24 different versions, with variations being displayed more than 370,000 time and a conversion ‘through to account open’ rate improvement of 39.09%.

“It’s about playing the long game which makes data really important. Digital marketers working in financial services need to understand that it’s not necessarily about that account conversion in a single visit because if you try and [optimise for] that, you’ll scare people off. [You need to collect] data that will show you what a client does not only in that visit but a week later, a month later or six months later. You need to focus on those localised conversion points - if the client has a question at a given point, it’s being able to give them the information they want there and then. If you can do that, then you’re building that relationship and they’ll hopefully come back to you later on.”

Technology + well-trained people = good digital marketing

It is of the utmost importance to Worle that any investment in technology is married with an investment in people. “The two go very much hand in hand. As an industry, we’ve probably invested in technology faster than we’ve invested in the people using it but technology alone cannot deliver that truly exceptional customer experience.” Conversely, people alone can’t deliver it in 2017: “we do need technology to enable it as well. Balancing the two is critical.”

In terms of the sexy technologies that have the media abuzz - e.g. AI, VR, IoT - Worle recognises that the regulatory environment of financial services means that some of them probably won’t work. “It’s difficult to understand how the Internet of Things would ever be applied to financial services—but I’ll probably end up eating my words on that in three years’ time!

“Artificial intelligence is an interesting one, but it’s voice interfaces that we’re watching the most closely. It has the opportunity to be the next mobile app explosion, with some exciting implications for the finance industry. For us in particular, the ability to get your investment valuations or make a trade by speaking to your car/phone/Amazon Echo.”

That said, regulation might stymie innovation: “You’re talking about an industry and a regulation framework which is built around ensuring that people get this or that document or read these five pages of terms and conditions before they transact. How does that change in a voice-activated world? Are you going to stand there for an hour and listen to some T&C’s?”

Digital marketing during tumultuous times

Worle concurs that we may be living through particularly ‘interesting’ times as regards current affairs, given the election of Donald Trump and Brexit. “We haven’t particularly changed our approach - what we’ve seen is that people’s need for good quality content and news has increased. People are perhaps being driven back to the more traditional channels for news and authoritative content and information, particularly when it comes to investments.

“Times have changed and are more uncertain - that is an issue with the nature of our business to a certain extent. The bottom could drop out of the market this afternoon and change what we do as a business for the next two years or beyond; it may be good or bad, who knows? That’s always meant that we’ve needed to be fast to react.”

He says that he’s not aware of his team having to tweak or kill a campaign (e.g. social media or email) because of a news event. “The role that we see ourselves playing is ensuring that we’re adding value to the content that’s out there, even content that’s not our own that we may be distributing from third-party news sources. We’re filtering it, we’re adding a layer of authority to it which means we’re cutting through some of the hype and some of the overreaction. That’s what investors want from us. Our content is very stable in that respect.”

“Trump and Brexit will create short term issues, but if you’ve got that long term goal and belief, certainly if you’re investing in companies and believe in their long term value, nothing changes there.” In this way, Hargreaves Lansdown is “trying to be that consistent, stabilising, reassuring voice to people”.

Chris Worle is Digital Strategy Director at Hargreaves LansdownWant more like this?

Want more like this?

Insight delivered to your inbox

Keep up to date with our free email. Hand picked whitepapers and posts from our blog, as well as exclusive videos and webinar invitations keep our Users one step ahead.

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy

Other content you may be interested in

Want more like this?

Want more like this?

Insight delivered to your inbox

Keep up to date with our free email. Hand picked whitepapers and posts from our blog, as well as exclusive videos and webinar invitations keep our Users one step ahead.

By clicking 'SIGN UP', you agree to our Terms of Use and Privacy Policy